April 02, 2023

Education fee financing in India helps parents and students manage school and college fees through easy monthly EMIs, instead of paying a large lump sum upfront. In this guide, you’ll understand how education fee financing works, how it differs from traditional education loans, and which option is best for Indian families

Who Is This Guide For?

This guide is designed for:

Parents paying K-12 school fees

Students planning higher education in India or abroad

Families comparing education loans vs fee financing

Anyone looking for flexible education EMI options in India

Traditional Education Loans vs Fee Financing: What’s the Difference?

Although they sound similar, education loans and fee financing serve very different purposes.

Traditional Education Loans

Loan amount: ₹4 lakh to ₹1.5 crore+

Designed mainly for higher education

Funds are usually credited to the student

Repayment tenure can extend up to 15 years

Often involves collateral or co-applicant

Student Fee Financing (Fintech Model)

Best suited for K-12 schools, upskilling, and vocational courses

Fee is paid directly to the institute

Short tenure: 3 to 18 months

Minimal paperwork and faster approvals

Feature | Education Loan | Fee Financing |

|---|---|---|

Cell 1-1 | ₹4L - ₹1.5Cr | ₹20K - ₹5L |

Tenure | Up to 15 years | 3–18 months |

Collateral | Often required | Not required |

Disbursal | To student | Direct to institute |

Best For | Higher education | School & short courses |

Many families still choose to pay fees upfront without realizing the long-term financial impact of that decision, which is why paying fees in a lump sum can be risky.

How Does the Education Loan Moratorium Period Work in India?

An education loan moratorium period allows students to delay EMI payments during the course duration and for 6-12 months after completion. This period gives students time to secure employment before repayment begins.

However, interest is not waived it is deferred.

Moratorium Repayment Options

Zero EMI: No payment during studies; interest is added to the principal later

Simple Interest EMI: Pay only interest to prevent principal growth

Partial Interest (PSI): Pay a small fixed amount (₹2,000-₹5,000/month)

Full EMI: Start full repayment immediately (lowest total cost)

Secured vs Unsecured Education Loans: Does College Rank Matter?

In India, employability potential now plays a major role in education loan approvals.

Secured Education Loans

Requires collateral (house, land, FD)

Lower interest rates: 8.3% - 11.25%

Higher loan eligibility

Unsecured Education Loans

No collateral required

Approval depends on:

Academic performance

Entrance exams (GRE, GMAT, etc.)

Institute reputation

Tier-1 institutes (IITs, IIMs) may get ₹50-₹75 lakh

Lower-ranked colleges may be capped at ₹20 lakh

Industry Insight

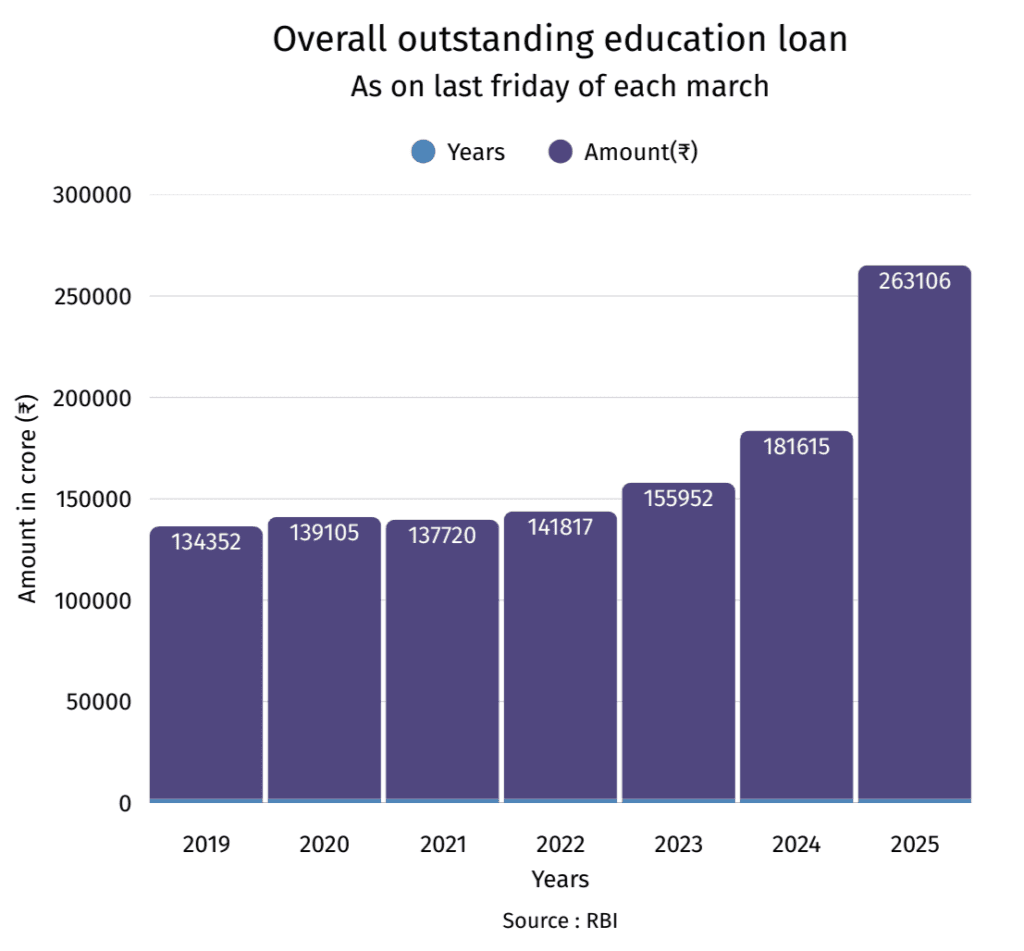

Recent lending trends in India show that a major share of education financing demand now comes from K-12 education and short-term courses, not just long-term degrees. Urban families increasingly prefer fintech-led fee financing models because of faster approvals, low documentation, and institute-direct payments filling gaps left by traditional bank loans.

Government Initiatives Supporting Education Financing in India

The Indian government has introduced digital platforms to improve access to education loans.

Vidya Lakshmi Portal

One application, multiple banks

Apply to up to 3 banks simultaneously

Access to 139+ education loan schemes

PM-Vidyalaxmi Scheme (Launched 2024)

Available for students in top 860 NIRF-ranked institutions

Collateral-free and guarantor-free loans

3% interest subsidy for families earning up to ₹8 lakh annually

Hidden Benefits: Tax Savings & TCS Relief

Education financing also provides significant financial advantages.

Section 80E Tax Benefit

Entire interest amount is tax-deductible

Available for up to 8 years

No upper deduction limit

Applicable only under the Old Tax Regime

TCS Exemption for Studying Abroad

Education loan-funded foreign remittances are TCS-exempt

Saves ₹25,000–₹50,000 upfront for families

Final Thoughts: Choosing the Right Education Financing Option

Education fee financing in India has evolved into a flexible financial bridge. Traditional education loans act as long-term pillars for higher studies, while fee financing offers quick, short-term support for school and course fees without long-term debt pressure.

The Key Takeaway

Think of education financing as a ladder long-term loans form the steps, and fee financing provides the quick rungs that help families manage year-to-year academic expenses smoothly.

For parents and students seeking fast, low-paperwork education fee EMI solutions, FeeMonk enables direct institute payments, flexible tenures, and a stress-free financing experience.

Frequently Asked Questions

Is education fee financing better than an education loan?

Fee financing is ideal for short-term needs like school fees, while education loans are better for long-term higher education.

Does fee financing affect credit score?

Yes. Timely EMI payments can improve your credit score, while missed payments may reduce it.

Can parents apply for education fee financing?

Yes. Most platforms allow parents or guardians to apply as primary borrowers.