April 02, 2023

Introduction

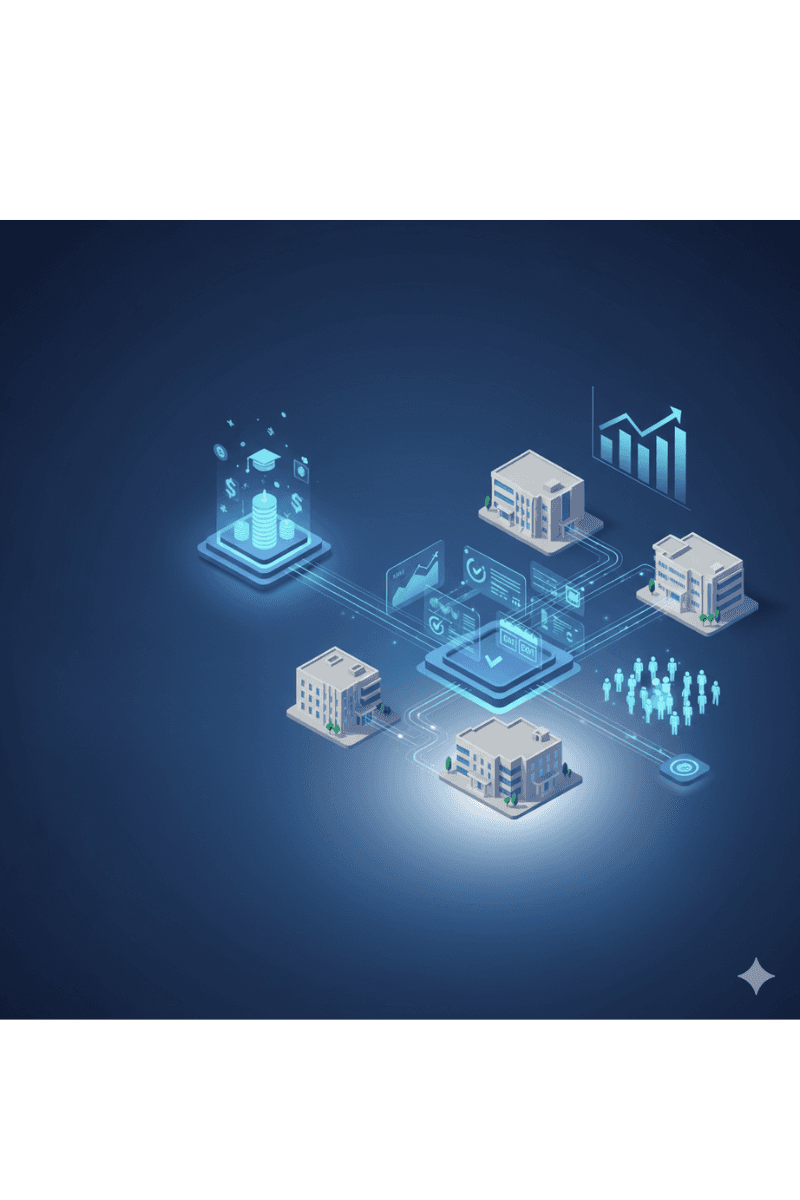

Across India, colleges and universities are facing a critical challenge declining admissions despite growing demand for higher education. One of the biggest reasons is no longer academic quality or infrastructure, but affordability.

Industry observations indicate that a majority of institutions experiencing enrollment drops point to student price sensitivity as the primary factor. Even after securing admission, many students fail to enroll simply because they are unable to pay the full semester or annual fee upfront.

To bridge this gap, forward-thinking institutions are now adopting fee financing for colleges as a strategic admissions and retention tool rather than treating it as a backend payment process.

Understanding the “Affordability Gap” in Indian Higher Education

Over the last two decades, tuition fees in Indian private colleges and universities have increased significantly, while household income growth has remained comparatively slower. This has created a clear affordability gap, especially for:

Middle-income families

Students who do not qualify for scholarships

Parents with limited short-term liquidity

For these students, the challenge is not willingness to pay but the inability to pay large fees in one lump sum. Institutions addressing this challenge increasingly rely on institution-led financing models rather than ad-hoc payment extensions. As a result, many confirmed admissions quietly turn into drop-offs before enrollment.

How Fee Financing Helps Colleges Increase Admissions

Fee financing solutions such as tuition installment plans, EMI-based payment options, and fintech-enabled fee management platforms break down large education costs into smaller, predictable monthly payments.

1️. Reducing “Sticker Shock” at the Decision Stage

Behavioral finance studies show that presenting fees as monthly EMIs instead of one-time payments significantly reduces the psychological burden on parents and students. This directly improves admission acceptance and enrollment conversion rates.

2️. Creating a Competitive Admissions Advantage

While many institutions offer installment options, awareness remains low. Colleges that actively communicate flexible fee payment plans during:

Admission counseling

Offer letters

Student portals

3️. Expanding Access Without Discounting Fees

Fee financing does not reduce tuition it restructures payments. Institutions offering structured EMI options consistently report:

Higher enrollment from middle-income families

Improved diversity without compromising revenue

This makes fee financing a sustainable alternative to fee discounts.

Improving Student Retention Through Financial Ease

Admissions success alone is not enough. Financial stress is a major contributor to student dropouts, especially in the first academic year.

When students fall behind on payments, many disengage without formal communication leading to what institutions often call “silent attrition.”

By offering interest-free or low-cost EMI options aligned with household income cycles, These options work best when paired with structured student fee financing programs that simplify repayment for families. colleges can:

Reduce financial anxiety

Improve fee compliance

Increase year-on-year retention

Programs observed across Indian and global institutions show that reducing financial friction directly improves re-enrollment rates, especially among first-generation learners.

Operational Benefits for Colleges and Universities

Fee financing is not just a student benefit it also delivers measurable operational efficiency for institutions.

1️. Reduced Administrative Workload

Modern education fee management platforms automate:

Payment reminders

Installment tracking

Reconciliation

This can reduce manual fee-related work for administrative teams by up to 50%, while significantly lowering reconciliation errors. Such efficiency is achieved through centralized education fee management systems designed specifically for institutions.

2️. Predictable and Stable Cash Flow

Structured installment schedules and automated collections enable:

Better revenue forecasting

Reduced payment volatility

Improved financial planning

3️. Faster, Centralized Reconciliation

Fintech-enabled platforms such as FeeMonk consolidate multiple payment channels into a single dashboard ensuring faster reconciliation and transparent reporting.

Why Fee Financing Is a Strategic Shift, Not a Payment Feature

For modern colleges, fee financing for education is no longer optional. It has become a core component of:

Admissions strategy

Student experience

Institutional sustainability

By partnering with education-focused, RBI-compliant fintech platforms like FeeMonk, institutions can offer secure EMI-based fee payment solutions while maintaining regulatory compliance and financial transparency.

In an era of rising education costs, colleges that prioritize financial flexibility and empathy will be the ones that consistently attract, enroll, and retain students.

FAQs

1. What is FeeMonk and how does fee financing work?

FeeMonk is an Indian education-focused fintech platform that enables structured EMI payments for educational fees. It operates in collaboration with RBI-registered NBFC partners, ensuring compliant, transparent, and secure financing. The process typically includes eligibility assessment, digital documentation, agreement execution, and direct fee disbursement to the institution upon approval.

2. How are tuition installment plans different from education loans?

Unlike traditional education loans, installment plans require repayments during the academic period and are usually interest-free or low-cost. Education loans, on the other hand, involve long-term repayment with accrued interest, often resulting in higher overall costs.

3. Does fee financing reduce the total cost of education?

No. Fee financing does not reduce tuition fees. It improves affordability by spreading payments across the academic year, helping families manage cash flow and avoid long-term interest burdens associated with loans.

4. What happens if an EMI payment is delayed?

Delayed payments may attract late fees as per lender or institutional terms and conditions. Continued non-payment can result in administrative actions such as academic holds, subject to institutional policies and financing agreements.

5. How do colleges benefit from offering fee financing options?

Institutions offering flexible payment plans consistently report higher enrollment conversion, improved retention, reduced administrative workload, and more predictable revenue streams making fee financing a strategic advantage.